In the digital age, staying ahead of fraudsters is crucial. This text highlights evolving scam tactics like phishing emails and social engineering. It stresses the importance of fraud prevention counseling and personal security consulting to empower individuals with awareness. Specific strategies focus on elder fraud protection for an aging population. Key strategies include securing online accounts, monitoring financial statements, and seeking professional guidance from personal security consultants. Regular fraud risk assessments are encouraged to identify vulnerabilities, mitigate risks, and protect against identity theft, cyber fraud, and scams.

Staying one step ahead of fraudsters is key to safeguarding your financial well-being. This comprehensive guide delves into the world of common fraud schemes and tactics, providing essential knowledge for everyone.

Learn to recognize targeted scams, protect personal information from identity theft, and master financial fraud awareness. Discover the power of a thorough fraud risk assessment and explore personalized security consulting options. Equip yourself with the tools needed to prevent scams, cyber fraud, and even elder fraud, ensuring a safer future.

Recognizing Common Fraud Schemes and Their Tactics

Recognizing Common Fraud Schemes and Their Tactics

In today’s digital era, fraudsters are increasingly sophisticated in their approaches, leveraging technology to craft convincing scams and manipulate unsuspecting individuals. From phishing emails disguised as legitimate business communications to sophisticated social engineering tactics, understanding common fraud schemes is essential for protecting oneself and one’s financial well-being. Fraud prevention counseling and personal security consulting play a crucial role in equipping folks with the knowledge to recognize and avoid these threats.

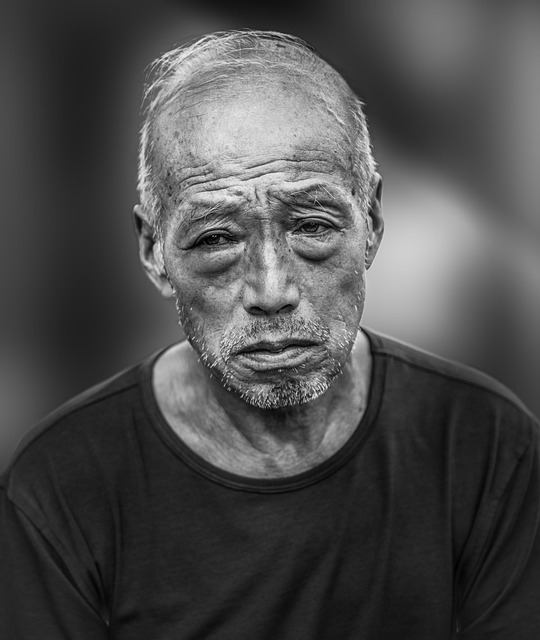

Elder fraud protection strategies are particularly vital, as older individuals may be more susceptible to manipulation due to health concerns or a lack of technological savvy. Financial fraud awareness and cyber fraud prevention involve staying informed about emerging trends and being vigilant with personal information. Regularly conducting a fraud risk assessment can help identify vulnerabilities and implement targeted measures for preventing scams and fraud. By staying proactive and engaging in these practices, individuals can safeguard their assets, preserve their identity, and protect themselves from becoming victims of fraudulent activities.

Protecting Personal Information: Identity Theft Prevention Strategies

Protecting your personal information is a vital step in preventing identity theft and fraudoff. In today’s digital age, where cyber fraud prevention has become paramount, it’s crucial to be vigilant. Start by securing your online accounts with strong, unique passwords for each platform. Enable two-factor authentication whenever possible, adding an extra layer of security that makes it harder for scammers to access your sensitive data. Be cautious when sharing personal details, especially on unfamiliar websites or over the phone. Regularly monitor your financial statements and credit reports for any suspicious activity, as early detection can prevent significant damage.

Consider seeking professional guidance from a personal security consultant who offers fraud prevention counseling and risk assessment services. They can provide tailored strategies for elder fraud protection, given that older individuals are often targeted due to their potential vulnerability. These experts can educate you on the latest scams and help implement robust identity theft protection measures. By being proactive in your financial fraud awareness, you can better navigate the digital landscape and protect yourself from common fraud schemes.

Financial Fraud Awareness: How to Spot and Avoid Scams

Staying informed is your first line of defense against financial fraud and scams. Understanding common tactics used by criminals can help you recognize and avoid potential threats. Financial fraud awareness is crucial for protecting your hard-earned money and personal information.

Regularly assess your financial situation and keep an eye on your accounts, looking for any unusual activity. Consider seeking advice from a personal security consultant or enrolling in fraud prevention counseling to learn more about identity theft protection and cyber fraud prevention strategies. These resources can provide valuable insights into elder fraud protection and help you develop effective strategies to mitigate risk. A thorough fraud risk assessment is key to staying one step ahead of potential scammers.

Comprehensive Fraud Risk Assessment and Personal Security Consulting

A comprehensive Fraud Risk Assessment is a crucial first step in protecting oneself from various scams and frauds. This involves meticulously analyzing one’s financial activities, digital footprint, and potential exposure to common fraud schemes. By identifying vulnerabilities, individuals can proactively seek tailored personal security consulting services. Such consulting offers valuable insights into fraud prevention counseling, helping clients understand the latest tactics employed by cybercriminals and scammers.

Specialized consultants provide identity theft protection strategies, educate on financial fraud awareness, and assist in implementing robust security measures. This proactive approach is particularly vital for at-risk populations, such as the elderly, who are often targeted by elder fraud protection schemes. Regularly updating one’s knowledge about emerging cyber fraud prevention techniques through these assessments ensures a strong defense against financial loss and identity theft.

By recognizing common fraud schemes, implementing robust identity theft protection measures, and staying vigilant against financial fraud, individuals can significantly enhance their cybersecurity posture. Personal security consulting and a comprehensive fraud risk assessment are essential steps in mitigating potential threats. Through proactive fraud prevention counseling, everyone—especially the elderly—can protect themselves from scams and fraud, ensuring peace of mind in today’s digital landscape.